MICHAEL BLAXLAND

The Post newspaper, January 28, 2009.

A NEWCASTLE community is preparing to take banking to the people.

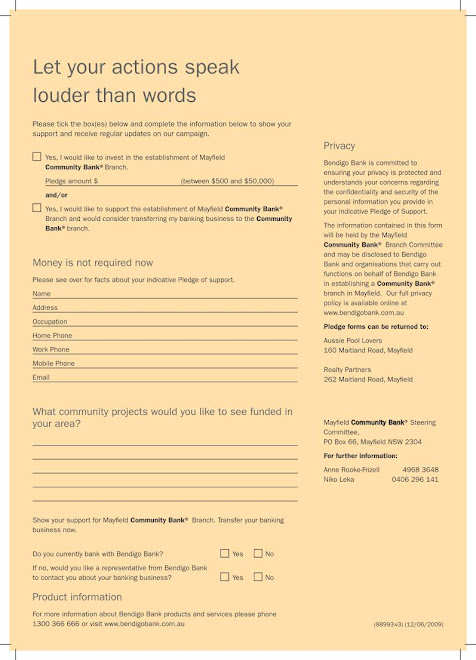

Initial meetings have been held to start a community bank in Mayfield, under the auspices of the Bendigo Bank.

The financial institution has a “community bank” model which allows towns or suburbs to control and staff their own branch and profits are returned to the local community.

Mayfield committee member Niko Leka said a meeting was held last week and a further public gathering would be held at the end of March.

“We need up to 18 people for a steering committee, and then the project can really start to get up and running,” he said.

Bendigo Bank group managing director Rob Hunter said the community bank movement started in 1998 when Bendigo Bank partnered with the Victorian communities, Rupanyup and Minyip, to pilot a return to banking services in their towns.

“It succeeded to the point where $100,000 per year is now made available for local community projects in the area,” he said.

“Community bank branches deliver employment opportunities for local people, keep local capital in the community, are a local investment option for shareholders and provide a source of revenue for important community projects determined by the local community.

Mayfield Mainstreet co-ordinator Kathie Heyman said there was great enthusiasm in the suburb for the initiative.

“Anything that brings business and community support is welcome,” she said.

“Mayfield Mainstreet can see the initiative as a way of providing funds for community development, services and improvements.

“Bendigo community banks have been established on the Central Coast with great success and this would be a coup for Mayfield to have the first one in the Newcastle region.

“Our shop owners get many customers who use Bendigo through other branches and Mayfield would become the regional centre for the bank.”

A feasibility study is expected to be conducted in coming months and, if positive, the next step will be the issuing of shares in the local branch which community members can buy.

Those local shareholders will help determine where profits will be allocated.